Market Overview

Drilling tools manufactured and supplied by Robit are used for the needs of the mining, quarrying and forepoling, underground construction and well drilling industries.

Market demand remained at a good level in the mining sector during 2024, but the expected turnaround in demand in the construction sector did not materialise. Demand in the construction industry was weak throughout the year. Demand for exploration drilling also weakened. In a challenging market, the company managed to increase sales in both Top Hammer and Geotechnical businesses. The decline in net sales was entirely driven by Down the Hole business, which suffered from weak demand in the construction industry and the expiry of a major supply contract during 2024, which could not be fully replaced with new customers.

Robit’s present market share, competitive products, extensive geographical coverage and the steady demand typical of drilling tools ensure good opportunities for Robit to grow by gaining market share from other operators in the industry. This means focusing resources more specifically on selected target markets. In addition, the company expects the overall market for drilling tools to grow beyond economic cycles by approximately 3–5 percent per year.

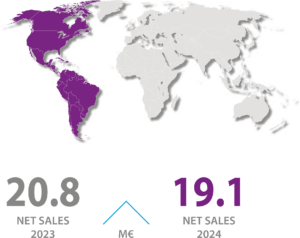

AMERICAS

Net sales in the Americas decreased by 8.1 per cent in 2024. The decline was mainly due to the mining industry in South America, where customer acquisition did not progress as planned. In North America, net sales remained stable.

Robit experienced growth in the Geotechnical segment in the region. The company had among others significant Geotechnical deliveries for a large port project in the Caribbean. The distributor network also strengthened during the year, especially in the strategically important US quarrying and construction segment.

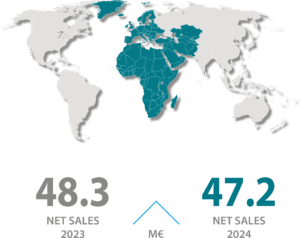

EMEA & EAST

EMEA & East sales activity is divided into four main regions: the Nordic countries, Central Europe, Middle East and Africa, and East. In 2024, demand in the construction industry was low, especially in the Nordic countries and Central Europe, which are important construction industry markets for Robit.

Despite the weak market conditions, the company was able to increase sales in the Geotechnical business, which focuses on the construction industry. On the other hand, in the well drilling segment, which is important for the company’s Down the Hole business, sales declined sharply, due to the weak market. In Southern Africa, the company won several new customers and grew in the region during 2024. In the East region, the company’s sales also grew clearly from the previous year, even though the company does not sell to Russia or Russian customers.

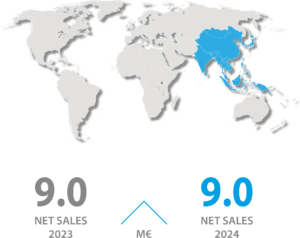

ASIA

In the Asia region, Robit focuses on the construction industry, especially tunnelling and mining. The construction industry’s relative share of net sales is higher in Asia than in the company’s other markets. The poor demand in the construction industry contributed negatively to net sales in Asia. The company’s sales remained stable

in the region, growing by 0.6 per cent.

In South Korea, an important market for Robit, market activity for construction projects was weak and this negatively impacted the company’s net sales. In the rest of Asia, Robit’s net sales increased, and the company succeeded in strengthening its position in the market. Robit continued its active cooperation with its distributors to increase market share and customer coverage.

AUSTRALASIA

Robit’s business in the Australasia region is mainly focused on mining. The market demand situation was good for production drilling, but the market for exploration drilling was weaker than in the previous year. Net sales in the region increased slightly thanks to new customers. The new customers were mainly underground mines that use Top Hammer drilling tools.

In the region, a major supply contract in Down the Hole expired at the end of June, which weakened sales in the second half of the year. The company has several potential sales opportunities in the region, particularly in underground mines, which are among the company’s strategic priorities.